Unlocking Convenience: A Complete Guide to Net Banking with ICICI Bank

In today's fast-paced world, convenience is key, and ICICI Bank’s net banking service stands at the forefront of this revolution. With the click of a button, you can manage your finances, pay bills, and transfer money with ease, all from the comfort of your home. Whether you're a seasoned digital banking user or new to the concept, this complete guide to net banking with ICICI Bank is designed to help you unlock seamless banking experiences. From setting up your account to exploring advanced features such as investment options and personalized alerts, we’ll walk you through each step. Discover how ICICI Bank empowers you to take control of your financial life anytime, anywhere, making banking not just simpler, but truly effortless. Get ready to dive into the world of intelligent banking at your fingertips!

Overview of ICICI Bank's Net Banking Services

ICICI Bank, one of India's leading private sector banks, is known for its innovative and customer-centric banking solutions. Among its many services, ICICI Bank's net banking stands out as a robust platform designed to cater to the diverse needs of its customers. This digital banking service enables users to manage their finances seamlessly over the internet, providing a range of functionalities that can be accessed from anywhere, at any time. Whether you're seeking to check account balance, transfer funds, pay bills, or even invest in mutual funds, ICICI Bank's net banking has you covered.

The net banking service by ICICI Bank is not just comprehensive but also incredibly user-friendly. The interface is designed to be intuitive, ensuring even those who aren’t tech-savvy can easily navigate through it. With a few clicks, users can perform a multitude of banking operations, saving them the time and effort of visiting a physical branch. This convenience is especially valuable in today's fast-paced world, where time is of the essence, and efficiency is paramount.

Moreover, ICICI Bank's net banking service is continuously evolving, incorporating the latest technological advancements to enhance the user experience. The bank regularly updates its platform, adding new features and improving existing ones based on customer feedback. This commitment to innovation ensures that ICICI Bank remains at the forefront of digital banking, offering its customers a modern, convenient, and secure way to manage their finances.

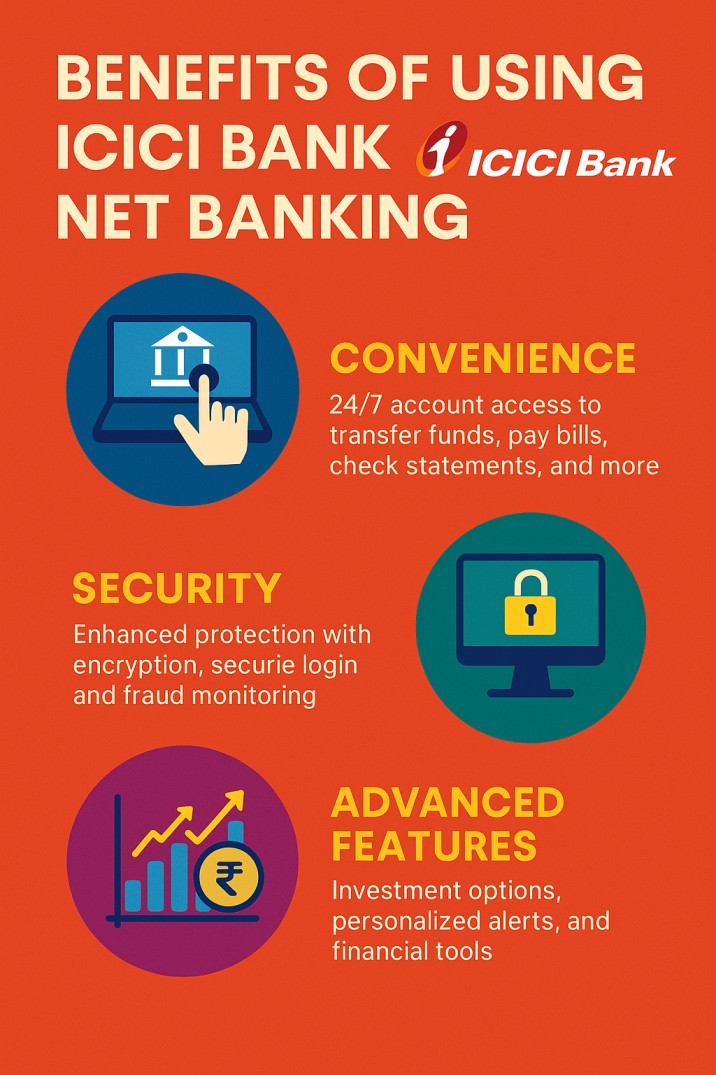

Benefits of Using ICICI Bank Net Banking

One of the primary advantages of using ICICI Bank’s net banking service is the sheer convenience it offers. With 24/7 access to your bank account, you can perform various banking transactions from the comfort of your home or office. Whether it's transferring money to another account, paying utility bills, or checking the account statement, everything can be done online without needing to visit a branch. This round-the-clock availability ensures you have control over finances at all times, making banking a hassle-free experience.

Another significant benefit is the enhanced security that comes with ICICI Bank’s net banking service. The bank uses state-of-the-art security measures to protect your account from unauthorized access and fraud. Features such as two-factor authentication, encryption, and secure login procedures ensure that your financial data remains safe. Additionally, the bank provides regular updates and alerts to keep you informed about any suspicious activities, further enhancing the security of your online transactions.

ICICI Bank’s net banking service also offers a range of advanced features that cater to diverse financial needs. From investment options like mutual funds and fixed deposits to personalized alerts and financial planning tools, the platform provides everything you need to manage your money effectively. These features not only help you keep track of your finances but also assist in making informed financial decisions. By leveraging these tools, you can optimize your savings and investments, ensuring long-term financial stability and growth.

How to Register for ICICI Bank Net Banking

Registering for ICICI Bank net banking is a straightforward process that can be completed in a few simple steps. Before you begin, ensure you have your account number, registered mobile number, and your debit card details handy. These details will be required during the registration process to verify identity and link your account to the net banking service.

To begin the registration process, visit the official ICICI Bank website and navigate to the net banking section. Here, you will find an option to register for net banking. Click on this option, and you will be directed to a registration form. Fill in the required details, including your account number, mobile number, and debit card information. Once you have entered all the necessary information, you will receive a one-time password (OTP) on your registered mobile number. Enter the OTP to verify your identity and proceed to the next step.

After verifying your identity, you will be prompted to create a user ID and password. Choose a user ID that is easy to remember but difficult for others to guess. Your password should be strong, combining letters, numbers, and special characters for added security. Once you have created your user ID and password, submit the form to complete the registration process. You will receive a confirmation message, and you can now log in to your ICICI Bank net banking account using the credentials you have just created.

Step-by-Step Guide to Logging into ICICI Bank Net Banking

Once you have successfully registered for ICICI Bank net banking, logging in is a simple process that allows you to access a wealth of banking services at your fingertips. To log in, visit the official ICICI Bank website and click on the “Login” button located in the top right corner of the homepage. You will be directed to the net banking login page, where you will need to enter your user ID and password.

After entering your user ID and password, click on the “Login” button to proceed. You may be prompted to answer a security question or enter an OTP that was sent to your registered mobile number for additional security. This two-factor authentication ensures only authorized users can access your account, providing an extra layer of protection against fraud.

Once you have successfully logged in, you will be directed to the net banking dashboard. This dashboard provides a comprehensive overview of your account, including your account balance, recent transactions, and quick links to various banking services. From here, you can navigate to different sections such as fund transfers, bill payments, and investment options. The intuitive layout and user-friendly design make it easy to find and use the services you need, ensuring a seamless banking experience.

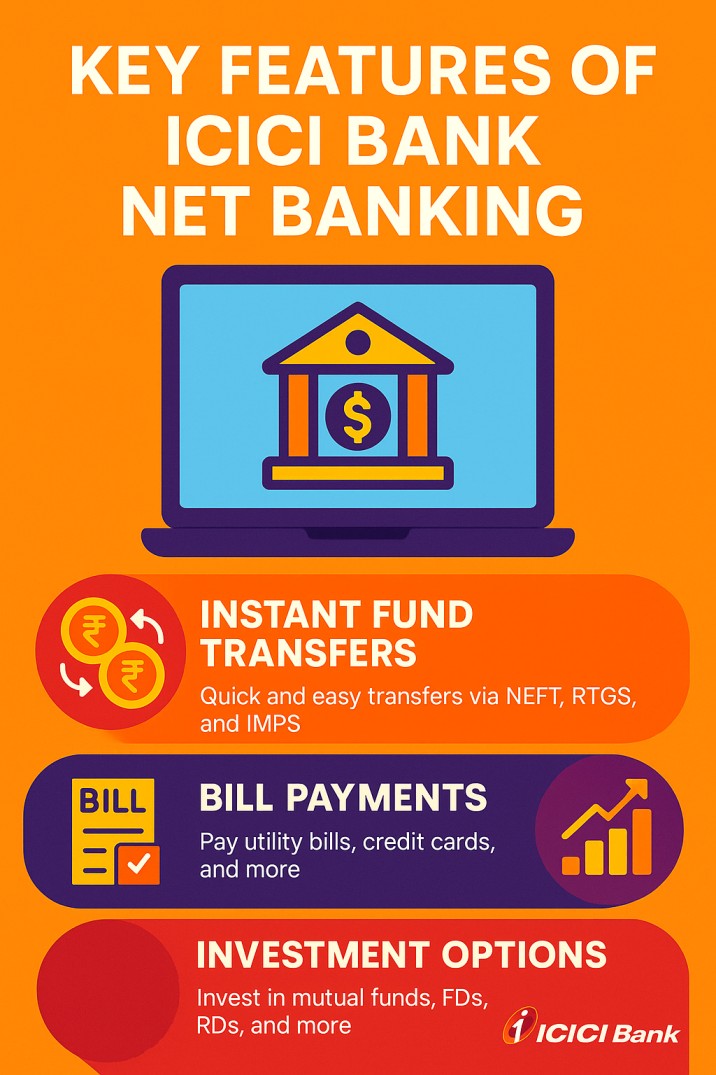

Key Features of ICICI Bank Net Banking

ICICI Bank net banking offers a plethora of features designed to meet the diverse needs of its customers. One of the standout features is the ability to perform instant fund transfers. Whether you need to transfer money to another ICICI Bank account or to an account with a different bank, the process is quick and easy. The platform supports various transfer options, including NEFT, RTGS, and IMPS, allowing you to choose the method that best suits your needs.

Another notable feature is the bill payment service, which allows you to pay your utility bills, credit card bills, and other recurring expenses with ease. The platform supports a wide range of billers, including electricity, water, gas, and telecommunications providers. You can set up automatic bill payments to ensure that your bills are paid on time, avoiding late fees and penalties. Additionally, you can view and manage your bill payment history, providing a clear record of your expenses.

Investment options are also a key feature of ICICI Bank’s net banking. The platform allows you to invest in mutual funds, fixed deposits, recurring deposits, and more. One can browse through various investment options, compare their performance, and make informed decisions based on your financial goals. The platform also offers tools for financial planning, helping you create a personalized investment strategy. With these features, ICICI Bank net banking empowers you to grow your wealth and achieve your financial objectives.

Security Measures for Safe Net Banking

Security is a top priority for ICICI Bank, and its net banking service incorporates multiple layers of protection to ensure the safety of your financial information. One of the primary security measures is two-factor authentication, which requires you to verify your identity using both your password and a one-time password (OTP) sent to your registered mobile number. This ensures that even if someone obtains your password, they cannot access your account without the OTP.

Encryption is another critical security measure used by ICICI Bank. All data transmitted between your device and the bank's servers is encrypted, making it difficult for unauthorized parties to intercept and read the information. This encryption ensures that your financial data remains confidential and secure during online transactions. Additionally, the bank utilizes firewalls and intrusion detection systems to safeguard its servers against unauthorized access.

ICICI Bank also provides regular security updates and alerts to keep you informed about potential threats and how to protect yourself. The bank advises its customers to use strong passwords, avoid sharing their login credentials, and regularly monitor their accounts for any suspicious activity. By following these best practices and taking advantage of the security measures provided by ICICI Bank, you can enjoy a safe and secure net banking experience.

Troubleshooting Common Issues with ICICI Bank Net Banking

Despite the many advantages of ICICI Bank net banking, users may occasionally encounter issues that can disrupt their online banking experience. Common problems include login difficulties, transaction failures, and technical glitches. Fortunately, most of these issues can be resolved with a few simple troubleshooting steps, ensuring you can quickly get back to managing your finances online.

If you are having trouble logging into your ICICI Bank net banking account, the first step is to check your internet connection. A stable and secure connection is essential for accessing the net banking platform. If your connection is stable and you are still unable to log in, ensure that you are entering the correct user ID and password. If you have forgotten your password, you can use the "Forgot Password" feature to reset it. Follow the instructions provided to create a new password and regain access to your account.

In the event of a transaction failure, it is important to verify that all the details entered are correct. Double-check the recipient's account number, IFSC code, and the amount to be transferred. If the transaction still fails, it could be due to technical issues or network downtime. In such cases, wait for a few minutes and try again. If the problem persists, contact ICICI Bank's customer support for assistance. The bank's support team is equipped to handle such issues and will guide you through the necessary steps to resolve the problem.

Technical glitches, such as slow loading times or unresponsive pages, can also hinder your net banking experience. Clearing your browser's cache and cookies or using a different browser can often resolve these issues. Additionally, ensure that your browser is up to date, as outdated versions may not be compatible with the net banking platform. If you continue to experience technical difficulties, contact ICICI Bank's technical support team for further assistance.

Mobile Banking vs. Net Banking: Which is Better?

With the advent of digital banking, customers now have the option to choose between mobile banking and net banking. Both platforms offer a range of features and functionalities, but each has its own set of advantages and limitations. Understanding the differences between the two can help you determine which option is better suited to your needs.

Mobile banking, as the name suggests, allows you to manage your finances using a mobile device, such as a smartphone or tablet. The ICICI Bank mobile banking app offers a user-friendly interface and provides access to a wide range of banking services, including fund transfers, bill payments, and account management. One of the key advantages of mobile banking is its portability. You can perform banking transactions on the go, making it a convenient option for those with busy lifestyles. Additionally, mobile banking apps often include features such as biometric authentication, which enhances security and provides a seamless login experience.

Net banking, on the other hand, is accessed through a web browser on a desktop or laptop computer. While it offers the same range of services as mobile banking, the larger screen and more comprehensive interface make it easier to navigate and perform complex transactions. Net banking is particularly beneficial for tasks that require detailed information or multiple steps, such as applying for loans, managing investments, or accessing detailed account statements. Additionally, net banking platforms often provide more advanced features and tools for financial planning and analysis.

Ultimately, the choice between mobile banking and net banking depends on your individual preferences and requirements. If you value convenience and the ability to manage your finances on the move, mobile banking may be a better option. However, if you prefer a more detailed and comprehensive interface for performing banking transactions, net banking may be more suitable. Many customers find that using both platforms in tandem allows them to enjoy the best of both worlds, providing flexibility and convenience for managing their finances.

Conclusion: Embracing the Future of Banking with ICICI Bank

In conclusion, ICICI Bank’s net banking service is a powerful tool that offers unparalleled convenience and flexibility for managing your finances. With its user-friendly interface, comprehensive range of features, and robust security measures, net banking with ICICI Bank is designed to meet the diverse needs of its customers. Whether you are looking to perform simple transactions, pay bills, or invest in your future, ICICI Bank’s net banking platform provides everything you need to take control of your financial life.

As digital banking continues to evolve, ICICI Bank remains committed to staying at the forefront of innovation. By continuously updating and enhancing its net banking platform, the bank ensures that its customers have access to the latest technological advancements and the best possible banking experience. This commitment to excellence is evident in the wide range of services and features offered, as well as the bank's dedication to customer satisfaction and security.

By embracing the future of banking with ICICI Bank, you can enjoy the convenience and efficiency of managing your finances anytime, anywhere. Whether you are a seasoned digital banking user or new to the concept, ICICI Bank’s net banking service empowers you to take control of your financial destiny. So why wait? Register for ICICI Bank net banking today and unlock a world of convenience and possibilities at your fingertips.