Unlocking Financial Freedom: How AI is Revolutionizing Personal Finance Management

In an era where technology dominates much of our daily lives, artificial intelligence (AI) is entering one of the most crucial arenas: personal finance management. Gone are the days of complex spreadsheets and overwhelming financial jargon. Today, AI tools are revolutionizing the way we budget, save, and plan for the future, making financial freedom more accessible than ever. Imagine an intelligent assistant that analyzes your spending habits, offers personalized budgeting tips, and even predicts your financial needs before they arise. As AI harnesses vast amounts of data to deliver tailored insights, individuals can not only take control of their finances but also make informed decisions that align with their long-term goals. Join us as we explore how AI is transforming personal finance into a streamlined and empowering experience, paving the way for a future where financial independence is within everyone's grasp.

The Importance of Personal Finance Management

Personal finance management is an essential aspect of overall well-being, yet it is often overlooked or misunderstood by many individuals. Properly managing one's finances ensures that you can meet your current obligations, plan for future needs, and achieve personal goals. Without a solid grasp of financial management, individuals may struggle with debt, be unable to save for emergencies, or miss out on investment opportunities that could secure their future. Effective financial management involves balancing income and expenditures, understanding credit, saving, and investing wisely.

Maintaining discipline and consistency is a big challenge in personal finance. Traditional methods such as manual bookkeeping or spreadsheets can feel slow and time-consuming. These old methods often lack the flexibility required to handle changing finances. This is where artificial intelligence (AI) benefits. AI provides automated, intelligent solutions, making managing finances simpler and less stressful. By using this method, you gain deeper insights into your financial habits, make informed choices, and achieve greater financial stability and freedom.

Another key part of good personal finance management is financial literacy. At times, people lack the knowledge to make financial decisions. This can lead to costly mistakes. Thus, AI-driven tools give practical solutions and offer real-time feedback and personalized advice. The mix of practical tools and education gives people confidence to manage their futures. As we explore and observe ways AI is transforming personal finance, it is clear that this technology is a necessity for financial independence today.

How AI is Transforming Budgeting and Expense Tracking

Budgeting and expense tracking are foundational elements of personal finance management, yet they can be daunting tasks for many people. AI is transforming these critical activities by automating processes, providing real-time insights, and offering personalized recommendations. AI-powered budgeting tools analyze spending patterns, categorize expenses, and identify areas where users can cut costs or reallocate funds. This automated approach dismisses much of the guesswork and manual effort involved in traditional budgeting methods.

One of the key advantages of AI in budgeting is its ability to provide real-time updates and alerts. For instance, if a user is approaching their budget limit in a particular category, the AI tool can send a notification to warn them. This proactive approach helps individuals stay on track with their financial goals and avoid overspending. Furthermore, AI can analyze historical data to predict future expenses and suggest adjustments to the budget accordingly. This dynamic and adaptive budgeting process ensures that users are always prepared for upcoming financial challenges and opportunities.

AI also excels in expense tracking by automatically categorizing transactions and providing detailed reports on spending habits. These insights enable users to identify trends, such as recurring expenses that may go unnoticed, and make informed decisions about their spending. Additionally, AI-driven expense tracking tools can integrate with various financial accounts, providing a comprehensive view of one's financial situation. This holistic approach simplifies the complexity of managing multiple accounts and ensures that no expense is overlooked. By leveraging AI for budgeting and expense tracking, individuals can gain a clearer understanding of their financial health and make more strategic decisions to achieve their financial goals.

AI-Powered Investment Strategies and Tools

Investing is a critical component of personal finance management, offering the potential for significant wealth growth over time. However, traditional investment strategies often require extensive knowledge, time, and effort to be effective. AI-powered investment tools are revolutionizing this landscape by providing sophisticated, data-driven insights and automating many aspects of the investment process. These tools leverage advanced algorithms and machine learning techniques to analyze market trends, assess risk, and optimize investment portfolios.

One of the most significant benefits of AI in investment management is its ability to process vast amounts of data quickly and accurately. AI algorithms can analyze historical market data, news, social media sentiment, and other relevant information to identify patterns and predict future market movements. This level of analysis would be impossible for a human to perform manually, making AI-powered tools invaluable for making informed investment decisions. Additionally, AI can continuously monitor the market and adjust investment strategies in real-time, ensuring that portfolios are always optimized for current conditions.

Another advantage of AI in investment management is its ability to provide personalized recommendations based on an individual's financial goals, risk tolerance, and investment horizon. AI-driven tools can create custom investment plans tailored to the unique needs of each user, taking into account factors such as age, income, and financial objectives. This personalized approach ensures that investment strategies are aligned with the user's overall financial plan, increasing the likelihood of achieving long-term success. By leveraging AI-powered investment tools, individuals can make more informed decisions, reduce risk, and maximize their potential for wealth growth.

The Role of Machine Learning in Financial Forecasting

Financial forecasting is a crucial aspect of personal finance management, as it helps individuals plan for future expenses, savings, and investments. Traditional forecasting methods often rely on historical data and simple statistical models, which can be limited in their accuracy and adaptability. Machine learning, a subset of artificial intelligence, is transforming financial forecasting by utilizing advanced algorithms and large datasets to make more accurate and dynamic predictions.

Machine learning models excel at identifying complex patterns and relationships within data that may not be apparent through traditional methods. These models can analyze a wide range of variables, such as economic indicators, market trends, and individual spending habits, to generate more accurate and reliable forecasts. By continuously learning from new data, machine learning models can adapt to changing conditions and improve their predictions over time. This dynamic approach ensures that individuals have access to the most up-to-date and relevant information for their financial planning.

One of the key advantages of machine learning in financial forecasting is its ability to provide personalized predictions based on an individual's unique financial situation. For example, a machine learning model can analyze a user's income, expenses, and savings habits to predict their future cash flow and identify potential financial challenges or opportunities. This level of personalization enables users to make more informed decisions about their financial future and take proactive steps to achieve their goals. By leveraging machine learning for financial forecasting, individuals can gain a clearer understanding of their financial trajectory and make more strategic decisions to secure their financial well-being.

Personalized Financial Advice through AI

In the realm of personal finance management, personalized advice is invaluable. However, obtaining tailored financial guidance has traditionally been the domain of professional financial advisors, which can be costly and inaccessible for many individuals. AI is democratizing access to personalized financial advice by providing intelligent, data-driven recommendations that are tailored to each user's unique financial situation and goals. This shift is making high-quality financial guidance more accessible and affordable for everyone.

AI-powered financial advisors, also known as robo-advisors, utilize advanced algorithms and machine learning techniques to analyze a user's financial data and provide personalized recommendations. These tools can assess various factors, such as income, expenses, investments, and financial goals, to generate customized advice on budgeting, saving, investing, and debt management. By leveraging AI, users can receive real-time, actionable insights specifically tailored to their needs, ensuring that their financial strategies align with their overall objectives.

One of the key benefits of AI-driven financial advice is its ability to continuously monitor a user's financial situation and provide ongoing recommendations. Traditional financial advisors may offer periodic reviews and updates, but AI-powered tools can provide real-time feedback and adjustments based on the latest data. This dynamic approach ensures that users always have access to the most relevant and up-to-date advices, allowing them to make more informed decisions and adapt their strategies as needed. By embracing AI for personalized financial advice, individuals can take control of their financial futures with confidence and clarity.

Enhancing Savings with AI-Driven Insights

Saving money is a fundamental aspect of personal finance management, yet many individuals struggle to consistently set aside funds for future needs. AI-driven insights are transforming the way people approach saving by providing intelligent, data-driven recommendations and automating the savings process. These tools leverage advanced algorithms and machine learning techniques to analyze a user's financial behavior, identify opportunities for saving, and optimize savings strategies.

One of the primary ways AI enhances savings is by providing personalized recommendations based on a user's spending habits and financial goals. For example, an AI-powered tool can analyze a user's transaction history to identify discretionary expenses that can be reduced or eliminated. By providing actionable insights and suggestions, these tools empower users to make more informed decisions about their spending and saving habits. Additionally, AI can help users set realistic savings goals and track their progress, ensuring that they stay motivated and on track to achieve their financial objectives.

AI-driven savings tools can also automate the savings process, making it easier for users to consistently set aside funds. For instance, some AI-powered apps can automatically transfer a portion of a user's income into a savings account based on predefined rules or real-time analysis of their financial situation. This automated approach eliminates the need for manual intervention and ensures that saving becomes a regular and effortless part of a user's financial routine. By leveraging AI for savings, individuals can build a stronger financial foundation and work towards their long-term goals with greater ease and efficiency.

Security and Privacy Considerations in AI Finance Tools

As AI-powered finance tools become increasingly integrated into personal finance management, security and privacy considerations are paramount. The sensitive nature of financial data demands robust security measures to protect users from potential threats, such as data breaches and identity theft. Additionally, users must have confidence that their personal information is being handled responsibly and transparently. Ensuring the security and privacy of AI finance tools is essential for building trust and encouraging widespread adoption.

One of the primary security concerns with AI finance tools is the protection of personal and financial data. AI-driven platforms must implement strict security protocols like encryption, multi-factor authentication, and regular security audits to safeguard user information. These measures help prevent unauthorized access and ensure that sensitive data remains secure. Furthermore, AI finance tools should be designed with privacy in mind, adhering to data protection regulations and best practices to ensure that user information is handled responsibly.

Transparency is another critical aspect of security and privacy in AI finance tools. Users must understand how their data is being collected, used, and stored by the platform. Clear and comprehensive privacy policies, along with user consent mechanisms, are essential for ensuring that individuals have control over their personal information. Additionally, AI finance tools should provide users with the ability to review and delete their data if desired. By prioritizing security and privacy, AI finance tools can build trust with users and create a safer, more reliable environment for managing personal finances.

Future Trends: The Next Frontier in AI and Personal Finance

As AI continues to evolve and mature, the future of personal finance management looks increasingly promising. Emerging trends and advancements in AI technology are poised to further revolutionize the way individuals manage their finances, offering even more sophisticated and personalized solutions. One of the most exciting developments is the integration of AI with other cutting-edge technologies, such as blockchain and the Internet of Things (IoT), to create more secure, transparent, and efficient financial ecosystems.

The integration of AI with blockchain technology has the potential to enhance the security and transparency of financial transactions. Blockchain's decentralized and immutable nature provides a robust framework for securely recording and verifying transactions, while AI can analyze these transactions to identify patterns and detect anomalies. This combination can help prevent fraud, streamline processes, and improve the overall integrity of financial systems. Additionally, AI-powered smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate and enforce financial agreements without the need for intermediaries.

Another exciting trend is the increasing use of AI in financial education and literacy. AI-powered platforms may provide personalized learning experiences, helping users understand complex financial concepts and develop essential skills. These tools can assess a user's knowledge level, learning preferences, and financial goals to deliver tailored educational content and interactive resources. By making financial education more accessible and engaging, AI can empower individuals to make informed decisions and achieve greater financial independence. As these trends continue to unfold, the future of personal finance management will be increasingly defined by intelligent, data-driven solutions that promote financial well-being for all.

Conclusion: Embracing AI for a Wealthier Future

The integration of AI into personal finance management is transforming the way individuals approach their financial well-being. From budgeting and expense tracking to investment strategies and financial forecasting, AI-powered tools offer intelligent, data-driven solutions that simplify and enhance every aspect of personal finance. By leveraging advanced algorithms and machine learning techniques, these tools provide personalized insights, automate processes, and empower users to make more informed decisions.

As we have explored, AI-driven finance tools offer numerous benefits, including real-time updates, personalized recommendations, and automated savings. These innovations not only make managing finances more accessible and efficient but also help individuals achieve greater financial stability and independence. Additionally, the ongoing advancements in AI technology promise to further revolutionize personal finance management, offering even more sophisticated and integrated solutions in the future.

Embracing AI for personal finance management is not just about adopting new technology; it is about taking control of your financial future with confidence and clarity. By harnessing the power of AI, individuals can gain deeper insights into their financial habits, make more strategic decisions, and work towards their long-term goals with greater ease and efficiency. As we move forward into this new era of AI-driven personal finance, the path to financial freedom becomes more attainable for everyone.

Frequently Asked Questions (FAQs) About AI

Q1: Are AI in personal finance apps secure?

A1: Leading AI-powered personal finance apps implement advanced security frameworks, including data encryption, multi-factor authentication, and continuous AI-based fraud monitoring. These platforms place a strong emphasis on user privacy and comply with stringent regulatory standards to ensure secure and reliable financial management.

Q2: Can AI replace human financial advisors?

A2: While AI can automate numerous tasks and deliver precise data-driven recommendations, it is unlikely to fully replace human financial advisors. AI excels in quantitative analysis and pattern recognition, but human advisors provide empathy, contextual understanding, and nuanced judgment in complex life and financial scenarios. The optimal approach combines both: AI manages the data, while human advisors offer strategic guidance and personalized insight.

Q3: How accurate are AI financial recommendations?

A3: AI-generated financial recommendations are highly precise, drawing on extensive data analysis, sophisticated machine learning algorithms, and your individual financial profile. Nevertheless, as they are based on historical trends and market projections, a certain degree of risk is unavoidable. It is prudent to evaluate the rationale behind these recommendations and ensure they align with your risk tolerance and financial objectives.

Q4: Are AI-powered personal finance apps expensive for users?

A4: Many AI-powered personal finance applications provide essential features free of charge to attract a broad user base. Advanced functionalities or personalized advisory services may be offered through a subscription model or a nominal percentage of assets under management. Costs are generally transparent and remain significantly lower than those associated with traditional financial advisory services, making professional financial guidance more accessible.

Q5: Can AI help manage finances?

A5: Absolutely! AI can transform the way you manage your finances by taking over tasks such as budgeting, retirement planning, monitoring accounts, and tracking expenses. Beyond automation, it dives deep into your financial data to uncover insights, empowering you to make smarter, faster, and more confident decisions with ease and precision.

Q6: Which AI is best for personal finance?

A6: When it comes to AI for personal finance, there’s no single “best” option—it all depends on what you want to achieve. Some tools shine at helping you stick to a budget, others act as robo-advisors guiding your investments, and some offer advanced portfolio management. The trick is selecting the AI that fits your goals, whether that’s growing your savings, planning for retirement, or taking your investments to the next level.

Q7: How is AI impacting finance?

A7: Imagine a world where your investments are smarter, your banking experience is seamless, and your money is safer than ever. That’s the power of AI in finance. From spotting fraud before it happens to personalizing services and navigating complex regulations, AI is reshaping how financial institutions operate—and how we manage our money. The future of finance isn’t just digital; it’s intelligent, efficient, and secure.

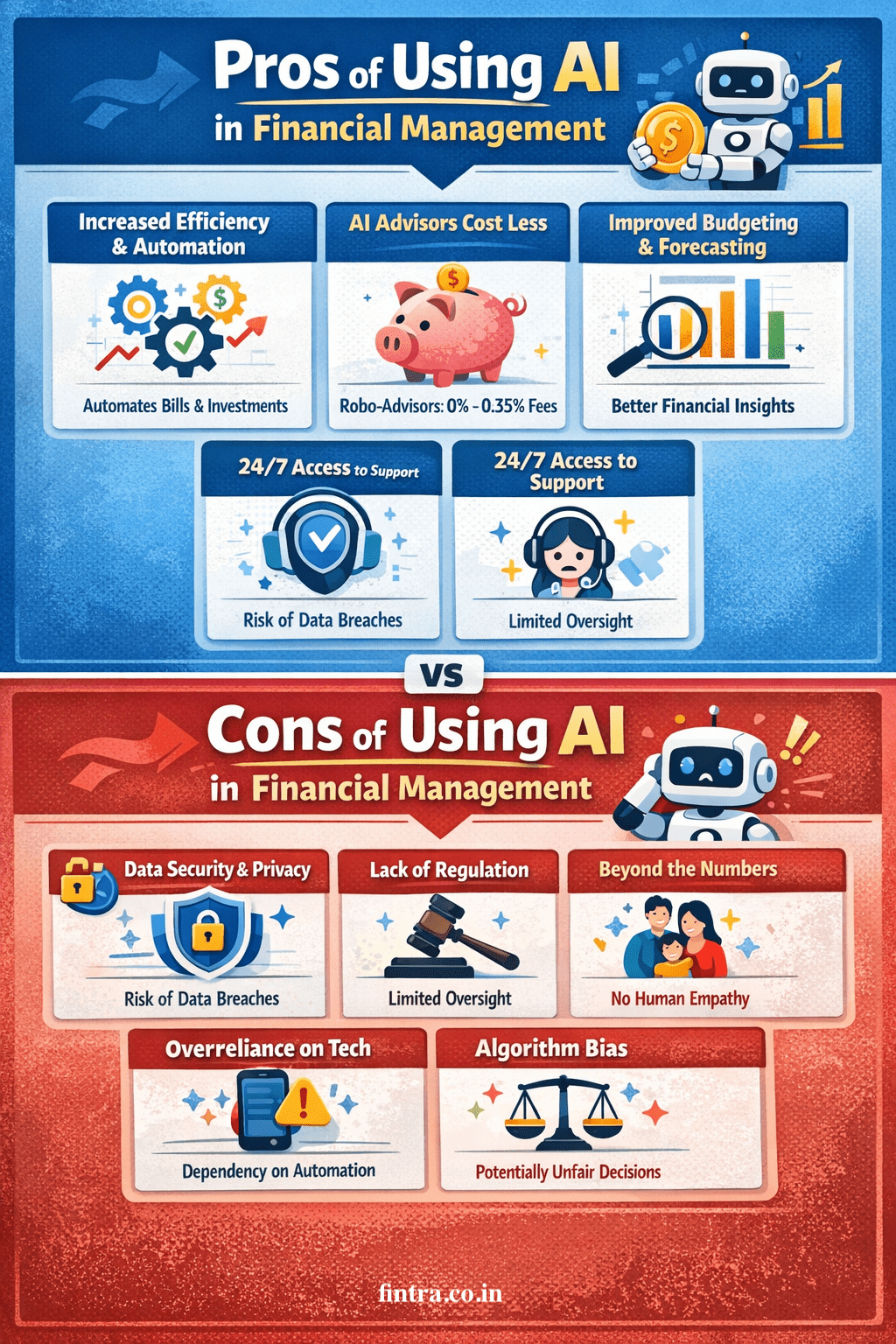

Q8: What are the benefits of AI in finance?

A8: AI is revolutionizing the financial world, offering a range of benefits that go beyond traditional tools:

- Streamlined Efficiency & Automation: Let AI handle repetitive tasks, freeing up time for smarter decision-making.

- Enhanced Security & Fraud Detection: Stay one step ahead with AI-powered systems that spot suspicious activity in real-time.

- Personalized Financial Planning: Receive tailored advice and strategies that fit your unique goals and lifestyle.

- Elevated Customer Experiences: From faster support to intuitive interfaces, AI makes banking smoother and more enjoyable.

- Boosted Profitability: Institutions and investors can leverage AI insights to maximize returns and uncover new opportunities.

Q9: What are the risks of AI financial tools?

Q9: While AI brings incredible benefits to the table, it’s not without its challenges. Some of the key risks include:

- Bias and lack of transparency – AI decisions can sometimes reflect hidden biases, making it hard to understand how outcomes are determined.

- Security and privacy threats – Sensitive financial data can be vulnerable to breaches if not properly protected.

- Fraud and misuse – There’s a risk that AI could be exploited to manipulate or steal information.

- Over-reliance on technology – Relying solely on AI without human oversight can lead to costly mistakes.

- Ethical and regulatory hurdles – Navigating the legal and moral landscape of AI is still a growing challenge.

- Job displacement – Automation may reshape the workforce, particularly in traditional financial roles.

AI is powerful—but using it wisely means understanding and managing these risks.