Unlocking Savings: How AI Can Help You Choose the Best Credit Card

Choosing the ideal credit card in India is challenging. With countless options from banks like HDFC, SBI, ICICI, Axis, and Amex, each with distinct rewards, fees, and eligibility criteria, many people select the wrong card. Artificial Intelligence (AI) intervenes by evaluating your spending, credit history, and lifestyle, helping you secure optimal rewards and minimal fees.

Choosing the best credit card in India no longer depends on time-consuming manual comparisons or outdated brochures. Artificial Intelligence (AI) streamlines the decision-making process by analyzing spending patterns, credit profiles, and usage behavior to deliver accurate, personalized credit card recommendations. Using data-driven insights, it enables consumers to maximize rewards, manage financial risk more effectively, and select credit cards that align closely with their individual financial goals.

This blog explains how AI helps you choose the best credit card and why it is becoming the preferred method for smarter credit decisions.

What Is AI-Based Credit Card Recommendation?

AI-based credit card recommendation uses machine learning algorithms to evaluate a user’s financial profile and match it with suitable credit card products. Instead of generic suggestions, AI systems analyze real spending data and compare it with thousands of card features to identify the most beneficial options. This approach ensures accuracy, relevance, and long-term savings.

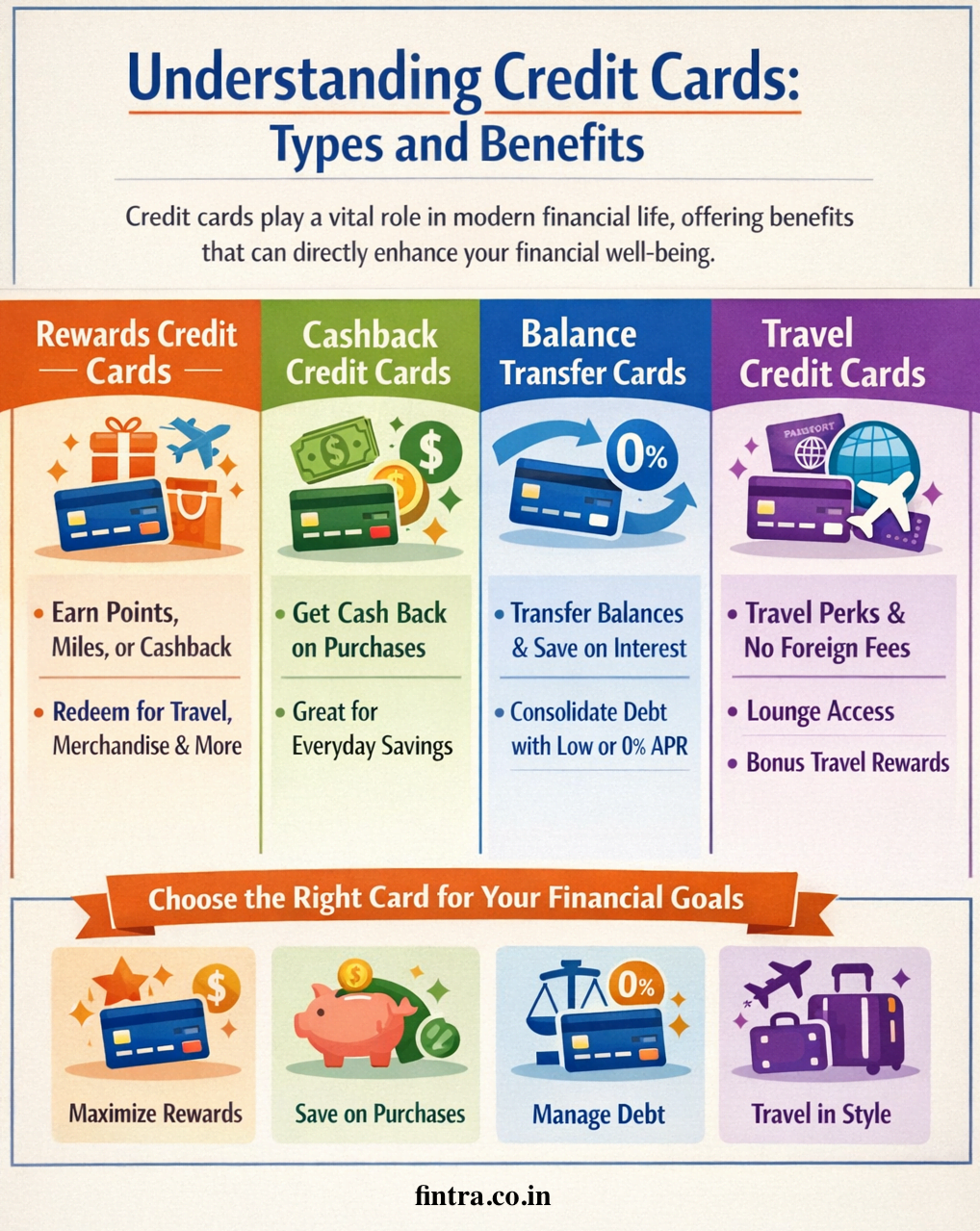

Understanding Credit Cards: Types and Benefits

Credit cards play a vital role in modern financial life, offering benefits that can directly enhance your financial well-being. Financial institutions offer a wide range of credit cards, each designed to align with specific spending patterns, lifestyle preferences, and financial needs of consumers. Popular options include rewards cards, cashback cards, balance transfer cards, and travel cards. By understanding the distinct features and advantages of each type, you can confidently pick a card that best aligns with your financial goals.

Rewards credit cards let you earn points, miles, or cashback on eligible purchases, transforming everyday spending into tangible benefits such as travel, merchandise, or statement credits. You can redeem these rewards for travel, merchandise, or even cash. Cashback credit cards, by contrast, put money directly back in your pocket by returning a percentage of each purchase as cash—making them perfect for simple, everyday savings. Balance transfer credit cards tackle debt head-on by letting you consolidate balances and take advantage of low or zero interest rates for a limited time.

Frequent travelers often turn to travel credit cards to enhance their journeys and maximize rewards. These cards actively deliver valuable perks, including travel insurance, airport lounge access, and generous bonus points on travel-related spending. Many also eliminate foreign transaction fees, allowing users to spend internationally without added costs. By understanding how each type of travel credit card works and the benefits it offers, you can confidently choose an option that aligns with your financial goals and complements your lifestyle.

The Role of AI in Analyzing Credit Card Options

Artificial Intelligence (AI) has revolutionized numerous aspects of our lives, and its role in analyzing credit card options is no exception. AI can process vast amounts of data quickly and accurately, making it an invaluable tool for evaluating the numerous credit card options available on the market. By leveraging machine learning algorithms, AI analyzes your spending patterns, financial behavior, and personal preferences to recommend the best credit card for your needs.

One of the primary advantages of AI in credit card analysis is its ability to handle complex data sets. Traditional methods of comparing credit cards can be time-consuming and overwhelming, especially when considering factors such as interest rates, annual fees, rewards programs, and additional benefits. AI simplifies this process by quickly sifting through the data to identify the most relevant options based on your unique financial profile.

Moreover, AI can continuously learn and adapt to changes in your financial situation. As your spending habits evolve, AI algorithms can update their recommendations to ensure that you are always using the most suitable credit card. This dynamic approach ensures you can maximize your savings and benefits, making AI an indispensable tool in the credit card selection process.

Key Features to Consider When Choosing a Credit Card

When choosing a credit card, several key features should be considered to ensure that you select the best option for your financial needs. One of the most critical features is the interest rate, also known as the Annual Percentage Rate (APR). The APR determines the cost of borrowing if you do not pay your balance in full each month. Lower interest rates can save you money in the long run, especially if you carry a balance.

Another important feature to consider is the rewards program. Different credit cards offer various types of rewards, like points, miles, or cash back. It is essential to choose a card with a rewards program that aligns with your spending habits and lifestyle. For example, if you travel frequently, a card that offers travel rewards and benefits may be more advantageous than a cash back card.

Fees are another crucial factor to consider. Many credit cards come with annual fees, foreign transaction fees, balance transfer fees, and other charges. It is vital to evaluate these fees in relation to the benefits offered by the card. In some cases, the rewards and perks may outweigh the costs; however, it is essential to do the math to ensure you are getting the best value.

How AI Algorithms Assess Your Financial Profile

AI algorithms use a variety of data points to assess your financial profile and recommend the most suitable credit card options. One of the primary data points considered is your credit score. Your credit score provides a snapshot of your creditworthiness and enables lenders determine the risk of lending to you. AI algorithms can analyze your credit score to identify credit cards that you are likely to be approved for and that offer the best terms.

In addition to your credit score, AI algorithms also consider your spending patterns. By analyzing your transaction history, AI can identify trends and preferences in your spending behavior. For example, if you frequently spend on dining and entertainment, AI can recommend credit cards that offer higher rewards or cash back in these categories.

AI algorithms also analyze your financial goals and preferences. For instance, if you are looking to pay down debt, it can recommend balance transfer credit cards with low or zero interest rates. If you prefer to earn rewards or travel perks, AI will suggest credit cards with generous rewards programs and travel benefits. By considering these various data points, AI can provide personalized and accurate recommendations that align with your financial profile.

Personalized Recommendations: How AI Tailors Options for You

One of the most significant advantages of using AI to choose a credit card is the ability to receive personalized recommendations tailored to your unique financial situation. Traditional methods of selecting a credit card often involve comparing generic options that may not fully align with your needs. AI, by contrast, delivers personalized recommendations by analyzing your unique financial profile, goals, and preferences, ensuring guidance that is tailored specifically to your needs.

Personalized recommendations begin with a thorough analysis of your financial data. AI algorithms consider factors such as your credit score, spending patterns, financial goals, and preferences to identify the most relevant credit card options. This tailored approach ensures that you receive recommendations that are not only suitable for your current financial situation but also help you achieve your long-term financial objectives.

Moreover, AI can continuously monitor and update its recommendations as your financial situation evolves. For example, if you receive a salary increase or experience a change in spending habits, AI can adjust its recommendations to ensure that you are always using the most advantageous credit card. This dynamic and personalized approach allows you to maximize your savings and benefits, making AI an invaluable tool in the credit card selection process.

Comparing Credit Cards: Traditional Methods vs. AI Solutions

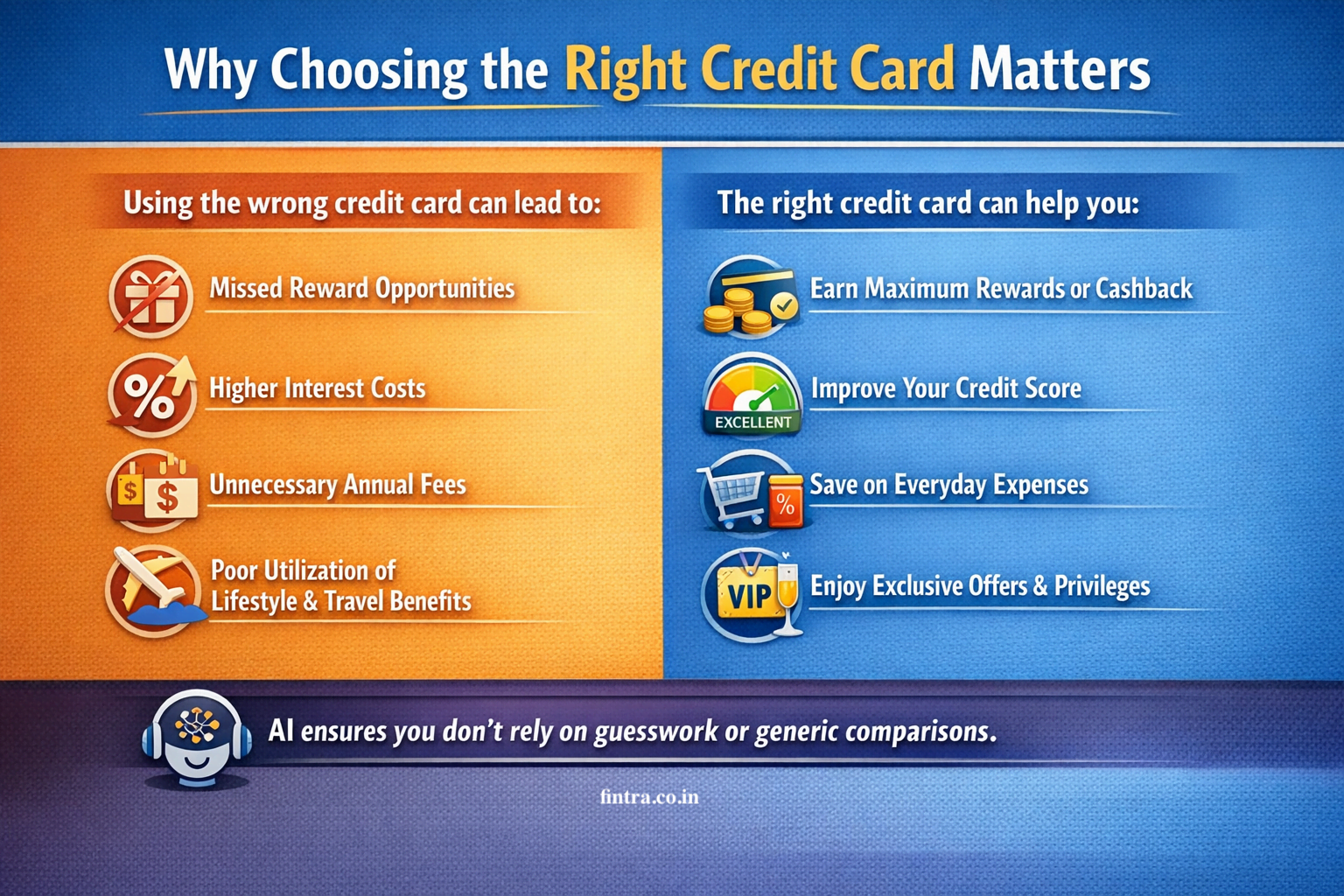

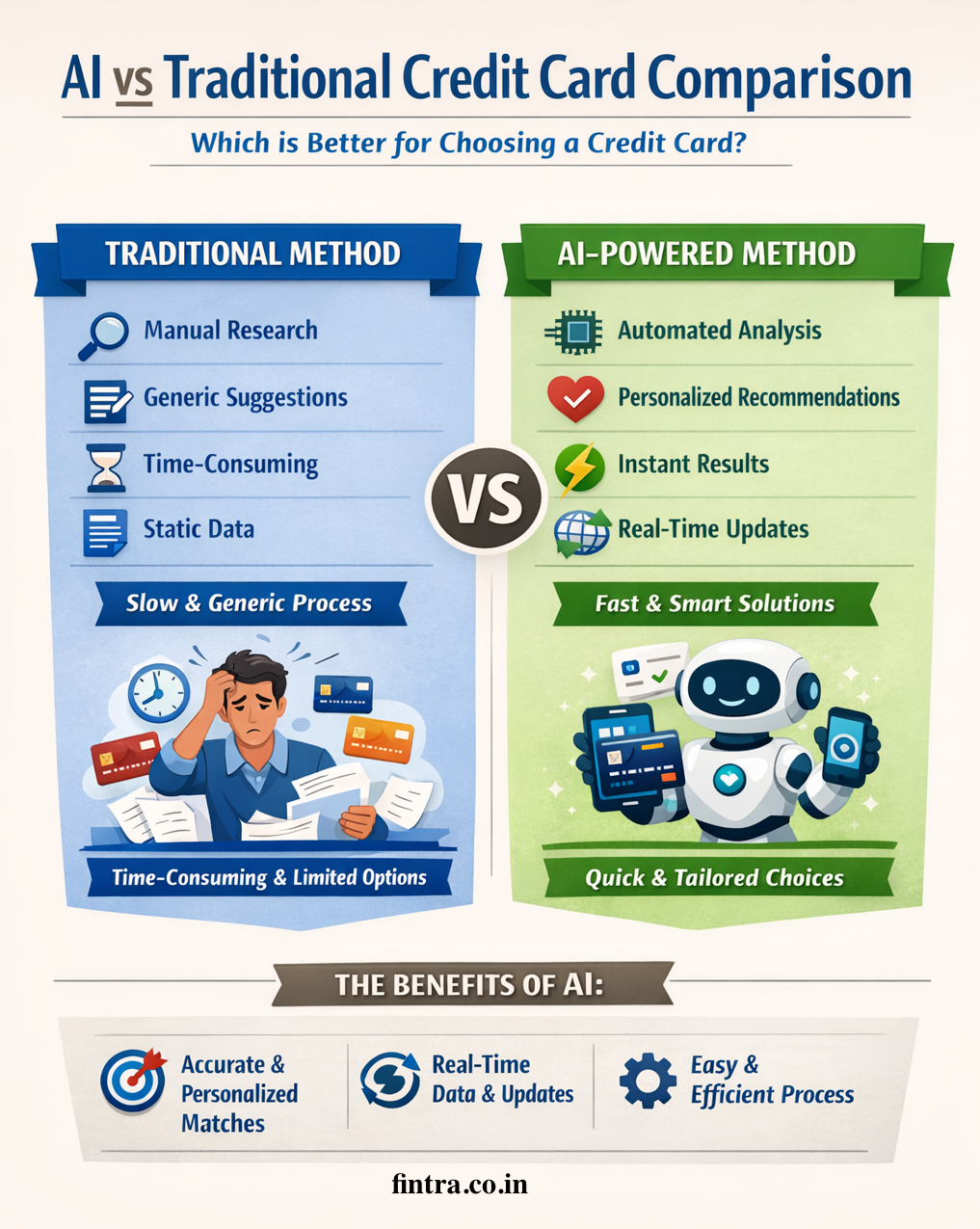

Comparing credit cards using traditional methods can be a time-consuming and overwhelming process. With numerous options available, each with its own set of features, fees, and benefits, it can be challenging to identify the best choice for your needs. Traditional comparison methods often involve manually researching and comparing different credit cards, reading reviews, and consulting financial experts.

One of the main drawbacks of traditional methods is the limited ability to process and analyze large amounts of data. Manually comparing credit cards requires significant time and effort, and at times, one may overlook important details or miss out on better options. Additionally, traditional methods may not always provide personalized recommendations tailored to your specific financial situation.

On the other hand, AI solutions offer a more efficient and accurate approach to comparing credit cards. AI quickly processes vast amounts of data and identifies the most relevant options based on your financial profile. This automated approach eliminates the need for manual research, ensuring you receive accurate and personalized recommendations. AI solutions also continuously update their recommendations, ensuring that you always have access to the most current and relevant credit card options.

Real-Life Examples of AI in Credit Card Selection

Several real-world examples highlight how artificial intelligence is transforming credit card selection. Leading financial institutions now use AI-driven algorithms to deliver personalized credit card recommendations tailored to individual customers. By analyzing key data points, such as spending behavior, income levels, lifestyle preferences, and credit history, AI helps banks identify and recommend credit cards that offer the most relevant rewards, cash back, and benefits. This data-driven approach not only improves customer satisfaction but also enables users to choose the best credit card for their specific financial needs, making the selection process faster, smarter, and more efficient.

For instance, a bank may use AI to identify customers who frequently travel and recommend a travel rewards credit card with perks such as airline miles, travel insurance, and no foreign transaction fees. Similarly, customers who spend heavily on groceries and dining may receive recommendations for cash back credit cards that offer higher rewards in these categories. This personalized approach not only enhances customer satisfaction but also helps banks build stronger relationships with their clients.

Another example is the use of AI-powered financial apps that provide credit card recommendations based on user data. These apps analyze users' financial behavior, preferences, and goals to suggest credit cards that offer the best value. By providing personalized and accurate recommendations, these apps enable users to make informed decisions and maximize their savings. These real-world examples showcase how AI-powered tools simplify credit card selection by recommending the most suitable options tailored to an individual’s financial needs and behavior.

Potential Risks and Limitations of Using AI for Financial Choices

While AI offers numerous benefits in the credit card selection process, it is important to be aware of the potential risks and limitations. One of the main concerns is data privacy and security. AI algorithms rely on access to sensitive financial data to provide personalized recommendations. If this data is not adequately protected, it could be vulnerable to breaches and misuse. It is essential to ensure that any AI-powered service you use has robust security measures in place to protect your personal information.

Another key limitation of AI is the risk of biased recommendations. AI systems rely heavily on the data used to train them, and any existing biases in that data can be carried forward into their outputs. For instance, if training datasets overrepresent certain demographics or financial behaviors, the AI may generate recommendations that disproportionately favor those groups. As a result, users should remain aware of these limitations and complement AI-driven insights with independent research and professional judgment when making financial decisions.

While AI can deliver valuable insights and personalized recommendations, it is not flawless. AI models rely on data patterns and probability-based predictions, which means a level of uncertainty is always present. For this reason, AI should be used as a supportive tool alongside your own research and financial judgment, not as a sole decision-maker. Understanding these limitations helps you make more informed choices and apply AI more effectively within your overall financial planning strategy.

Conclusion: Embracing AI for Smarter Financial Decisions

In conclusion, AI is transforming how consumers choose credit cards by making the process faster, more precise, and highly personalized. Using machine-learning algorithms, AI can evaluate large volumes of financial data—such as spending habits, income patterns, and reward preferences—to deliver recommendations tailored to an individual’s unique financial profile. This data-driven approach helps users identify cards that maximize rewards, savings, and overall value.

While AI-driven recommendations come with considerations such as data privacy and the risk of algorithmic bias, these challenges can be effectively managed through strong security practices and informed decision-making. When used responsibly, AI empowers consumers to make smarter, more confident financial choices rather than relying on generic comparisons or guesswork.

As technology continues to evolve, AI’s role in personal finance and credit card selection will only expand, offering even more refined and adaptive solutions. By staying informed and open to these innovations, individuals can leverage AI to simplify financial decisions, optimize credit card usage, and work more effectively toward their long-term financial goals.

Frequently Asked Questions (FAQs)

-

How does AI recommend the best credit card in India?

AI analyzes spending habits, credit profile, income, and lifestyle preferences to recommend credit cards that offer the highest value and approval probability.

-

Is AI-based credit card selection accurate?

Yes. AI utilizes data-driven models and continuously learns from user behavior, making recommendations more accurate than manual or generic comparison tools.

-

Can AI help improve my credit card approval chances?

Yes. AI suggests only those credit cards that match your eligibility, reducing the risk of rejection and protecting your credit score.

-

Is my data safe when using AI-powered credit card platforms?

Trusted platforms safeguard personal and financial information by using strong encryption and complying with strict data privacy and security regulations.

-

Are AI-recommended credit cards better than bank suggestions?

AI recommendations are unbiased and based on user data, while bank suggestions often promote specific products. AI focuses on what benefits the user most.