Mastering Forex Trading: 10 Proven Strategies to Boost Your Profits Today!

Are you ready to improve your Forex trading results? The foreign exchange market offers significant opportunities, and mastering its dynamics can enhance your financial outlook. In this blog, you will discover 10 proven strategies to strengthen your trading approach and increase your potential profits. Whether you are an experienced trader refining your methods or a beginner starting out, these practical insights will help you navigate the market’s complexities. We will cover essential topics, including risk management and technical analysis, to support your trading goals. Begin your journey toward Forex trading success with confidence.

Understanding Forex Market Dynamics

Forex trading, or foreign exchange trading, is the buying and selling of currencies in a global, decentralized market that operates 24 hours a day, five days a week. This continuous market allows traders to respond quickly to global economic events and news. To develop effective strategies, it's vital to know when the market is most active, which economic indicators matter, and how geopolitical events affect currency values.

One of the fundamental aspects of Forex market dynamics is the concept of currency pairs. Each trade involves two currencies, known as the base currency and the quote currency. For example, in the USD/EUR pair, the US dollar is the quote currency and the euro is the base currency. Therefore, the exchange rate indicates how much quote currency is required to purchase one unit of the base currency. Market participants, including banks, financial institutions, corporations, and individual traders, influence these exchange rates through their trading activities.

Market liquidity and volatility are also essential factors to consider. For example, liquidity refers to the ease with which a currency can be bought or sold without causing significant price changes. High liquidity typically results in tighter spreads and lower trading costs. Volatility, on the other hand, measures the degree of price fluctuations over a given period. While higher volatility can present more trading opportunities, it also increases the risk. Therefore, understanding the interplay between liquidity and volatility is vital for making informed trading decisions.

Key Terminology Every Trader Should Know

To navigate the Forex market effectively, traders must familiarize themselves with essential terminology. Pips, for instance, are the smallest price movement in a currency pair, typically representing a one-digit change in the fourth decimal place. Understanding pips is crucial for calculating potential profits and losses, as well as for setting stop-loss and take-profit orders.

Another important term is leverage, which allows traders to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also increases the potential for significant losses. Margin, closely related to leverage, is the amount of money required to open and maintain a leveraged position. Traders must monitor their margin levels to avoid margin calls, which can force the closure of positions to prevent further losses.

Additionally, terms like 'bullish' and 'bearish' describe market sentiment. A bullish market indicates rising prices, while a bearish market suggests falling prices. Knowing these terms helps traders communicate their strategies and understand market analyses. Similarly, understanding the difference between 'bid' and 'ask' prices is essential. The bid price is what a buyer is willing to pay for a currency, whereas the ask price is what a seller wants to receive. The difference between these prices, known as the spread, represents the cost of trading.

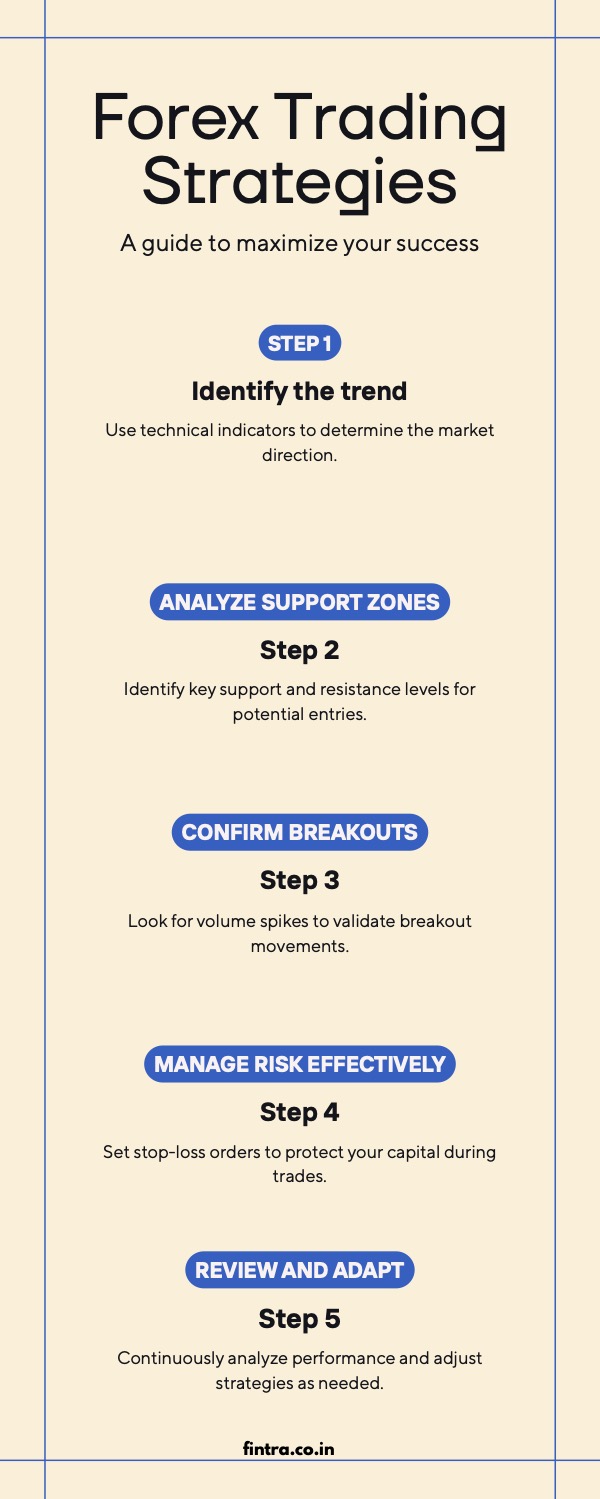

Proven Strategies for Successful Forex Trading

One of the most effective strategies for Forex trading is trend following. This involves identifying the direction in which a currency pair is moving and placing trades in the same direction. Trend-following strategies rely on technical indicators such as moving averages, which smooth out price data to reveal the underlying trend. By following the trend, traders can capitalize on the momentum and increase their chances of profitable trades.

Another proven strategy is range trading, which is used when a currency pair is moving within a defined range. Traders identify key support and resistance levels and place trades based on the currency's movement between these levels. Range trading works best in stable markets where prices are not exhibiting strong directional trends. This strategy requires patience and discipline, as traders must wait for prices to reach the support or resistance levels before entering trades.

Breakout trading is also a popular strategy, particularly in highly volatile markets. This approach involves identifying key levels of support or resistance and placing trades when the price breaks through these levels. Breakout traders aim to capture significant price movements that occur after a breakout. To implement this strategy effectively, traders employ technical indicators such as Bollinger Bands or volume analysis to confirm the strength of the breakout.

Risk Management Techniques in Forex

Effective risk management is crucial for long-term success in Forex trading. One essential technique is setting stop-loss orders, which automatically close a trade when the price reaches a predetermined level. This helps limit potential losses and protects trading capital. Traders should determine their stop-loss levels based on their risk tolerance and the volatility of the currency pair they are trading.

Position sizing is another critical aspect of risk management. This involves determining the appropriate amount of capital to allocate to each trade based on the trader's overall account size and risk tolerance. By limiting the size of individual trades, traders can reduce the impact of potential losses on their overall portfolio. A common rule of thumb is to risk no more than 1-2% of the trading account on a single trade.

Diversification is also an effective risk management strategy. By spreading investments across multiple currency pairs, traders can reduce the impact of adverse movements in any single pair. This approach helps mitigate risk and can lead to more stable returns over time. Additionally, traders should regularly review and adjust their risk management strategies to ensure they remain aligned with their trading goals and market conditions.

The Importance of Technical Analysis

Technical analysis is a cornerstone of Forex trading, involving the study of historical price data to predict future price movements. This method relies on various tools and indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracement levels. By analyzing charts and identifying patterns, traders can make informed decisions about when to enter and exit trades.

One of the primary benefits of technical analysis is its ability to provide objective trading signals. Unlike fundamental analysis, which requires interpreting economic data and news events, technical analysis relies on quantifiable data. This enables traders to develop systematic trading strategies and reduce the influence of emotions on their decision-making process.

Moreover, technical analysis can be applied across different time frames, making it suitable for various trading styles. Whether you're a short-term scalper or a long-term position trader, technical analysis tools can help identify profitable trading opportunities. By mastering technical analysis, traders can improve their market timing and enhance their overall trading performance.

Fundamental Analysis: How Economic Indicators Affect Forex

Fundamental analysis focuses on evaluating economic indicators and news events to determine the underlying value of a currency. Key economic indicators include interest rates, inflation rates, gross domestic product (GDP), trade balance, and employment data. These indicators provide insights into the overall health of an economy and can significantly influence currency values.

Interest rates, for example, play a crucial role in Forex trading. They are used by the central banks to control inflation and stabilize their currencies. Typically, higher interest rates attract foreign investment, leading to an appreciation of the currency. On the other hand, lower interest rates can result in a depreciation of the currency. Hence, traders closely monitor central bank announcements and interest rate decisions to anticipate market movements.

Trade data—such as the trade balance and current account balance—reflect the gap between a country’s exports and imports. When the trade balance is positive, it means the country exports more than it imports, which typically strengthens its currency. On the other hand, a negative trade balance can put downward pressure on the currency’s value. For instance, if India’s current account balance improves, the Indian Rupee is likely to appreciate against other currencies.

Employment data is another important indicator. High employment levels indicate a strong economy, which can boost investor confidence and lead to currency appreciation. On the other hand, rising unemployment can signal economic weakness and result in currency depreciation. By analyzing these and other economic indicators, traders can gain a deeper understanding of market trends and make more informed trading decisions.

Utilizing Trading Tools and Platforms

The right trading tools and platforms can significantly enhance your Forex trading experience. For example, there are various software programs available that allow traders to visualize price movements and analyze technical indicators. Some popular charting tools even offer a wide range of features, including customizable charts, technical analysis tools, and real-time market data.

Automated trading systems, also known as trading robots or expert advisors (EAs), can execute trades on your behalf based on predefined criteria. These systems can help eliminate emotional biases and ensure consistent implementation of your trading strategies. However, it's essential to thoroughly test and optimize automated systems before using them in live trading to ensure they perform as expected.

Economic calendars are another valuable tool for Forex traders. These calendars provide a schedule of upcoming economic events and releases, along with their expected impact on the market. By staying informed about key events, traders can anticipate potential market movements and adjust their strategies accordingly. Additionally, many trading platforms offer built-in news feeds and alerts to keep traders updated on the latest market developments.

Common Mistakes to Avoid in Forex Trading

Even experienced traders can fall into common pitfalls that undermine their success. One of the most prevalent mistakes is overtrading, or placing too many trades in a short period. Overtrading can lead to increased transaction costs, greater exposure to market risk, and emotional exhaustion. To avoid this, traders should develop a well-defined trading plan and stick to it, ensuring they only enter trades that meet their criteria.

Another frequent mistake is failing to use stop-loss orders. Without stop-loss orders, traders risk experiencing significant losses if the market moves against them. It's crucial to set stop-loss levels for every trade and adhere to them to protect your trading capital. Additionally, traders should avoid moving their stop-loss levels further from their entry point, as this can lead to larger losses and undermine their risk management strategy.

Chasing the market is another common error. This occurs when traders enter trades based on recent price movements rather than following their trading plan. Chasing the market often results in poor entry points and increased risk. To avoid this, traders should remain disciplined and patient, waiting for their predefined setups and signals before entering trades. By avoiding these common mistakes, traders can improve their chances of long-term success in the Forex market.

Conclusion

Mastering Forex trading requires a combination of knowledge, discipline, and effective strategies. By understanding the dynamics of the Forex market and familiarizing yourself with key terminology, you can build a strong foundation for your trading journey. Implementing proven strategies, such as trend following, range trading, and breakout trading, can help you capitalize on market opportunities and boost your profits.

Protecting trading capital and ensuring long-term success, risk management is essential. By setting stop-loss orders, determining appropriate position sizes, and diversifying your investments, you can mitigate risk and enhance your trading performance. Additionally, mastering technical and fundamental analysis can provide valuable insights into market trends, enabling you to make informed trading decisions.

Utilizing the right trading tools and platforms can streamline your trading process and improve your efficiency. By staying informed about economic events and avoiding common trading mistakes, you can navigate the Forex market with confidence. Remember, consistency and discipline are key to achieving your financial goals. Embrace the journey, continue learning, and refine your strategies to become a successful Forex trader.