Credit Cards vs. Debit Cards: The Ultimate Guide to Pros and Cons for Smart Spending

Turn every swipe into a smarter step toward wealth. In today's fast-paced financial landscape, choosing between credit cards and debit cards can seem daunting. Each option offers its own distinct advantages and drawbacks, which can significantly influence your financial well-being. Are you seeking to maximize rewards or bring in more spending discipline in your life? Fintra’s ultimate guide will unveil the pros and cons of credit cards and debit cards, providing the knowledge to make smart financial decisions. Whether you desire to build a credit score, earn cashback, or manage daily expenses, understanding these popular payment methods is essential for smart spending. Join us as we explore the features, benefits, and potential pitfalls of each card type, assisting you in navigating your financial journey confidently.

Understanding How Credit Cards Work

Credit cards let you borrow money from a bank, which you agree to repay later, usually with interest. When you use a credit card, the bank pays the merchant for you, and you build up a balance to pay back. You can avoid interest charges by paying this balance in full by the due date, or you can make a minimum payment and let the remaining balance gather interest. Interest rates on credit cards can vary widely, often depending on your credit score and the specific terms of the card.

One of the key functionalities of credit cards is the credit limit, which is the maximum amount you can borrow at any given time. Determined by the issuing bank, this credit limit is based on various factors, which include your credit history, income, and overall financial health. Exceeding this limit can result in penalties and fees, so it is crucial to monitor your spending and stay within the prescribed boundaries. Additionally, credit cards offer various features such as reward points, cash-back options, and travel perks, making them attractive to consumers who frequently use their cards for purchases.

Credit cards also play a key role in building and maintaining your credit score. Paying on time and using credit responsibly can boost your creditworthiness, making it easier to qualify for loans and other financial products in the future. On the other hand, missed payments and high credit utilization can harm your credit score, leading to higher interest rates and less borrowing power. Understanding how credit cards work and managing them wisely is crucial for maintaining financial health and achieving your long-term financial goals.

Understanding How Debit Cards Work

Debit cards offer a straightforward approach to spending because they are directly linked to an individual’s checking or savings account. When swiping a debit card, the amount is deducted immediately from the bank account. This ensures you spend only what you have, rather than borrowing. This direct link helps maintain control over spending and can be advantageous for those who prefer discipline in managing finances.

Unlike credit cards, debit cards do not offer a credit limit or the ability to carry a balance. This means that you cannot spend more money than you have in your account, which can help prevent overspending and reduce the risk of falling into debt. Many banks also offer overdraft protection, allowing you to cover transactions even if your account balance is insufficient. Do note that this service often comes with fees and must be used cautiously. Debit cards are widely accepted for both in-person and online transactions, making them a convenient option for everyday purchases.

In addition to the ease of use and immediate access to funds, debit cards often come with lower fees compared to credit cards. There are no annual fees, and transaction fees are usually minimal or non-existent, depending on your bank's policies. However, debit cards do not offer the same level of rewards and perks as credit cards, which can be a drawback for those looking to maximize their spending benefits. Despite this, the simplicity and direct nature of debit cards make them an appealing choice for many consumers who prioritize financial discipline and straightforward money management.

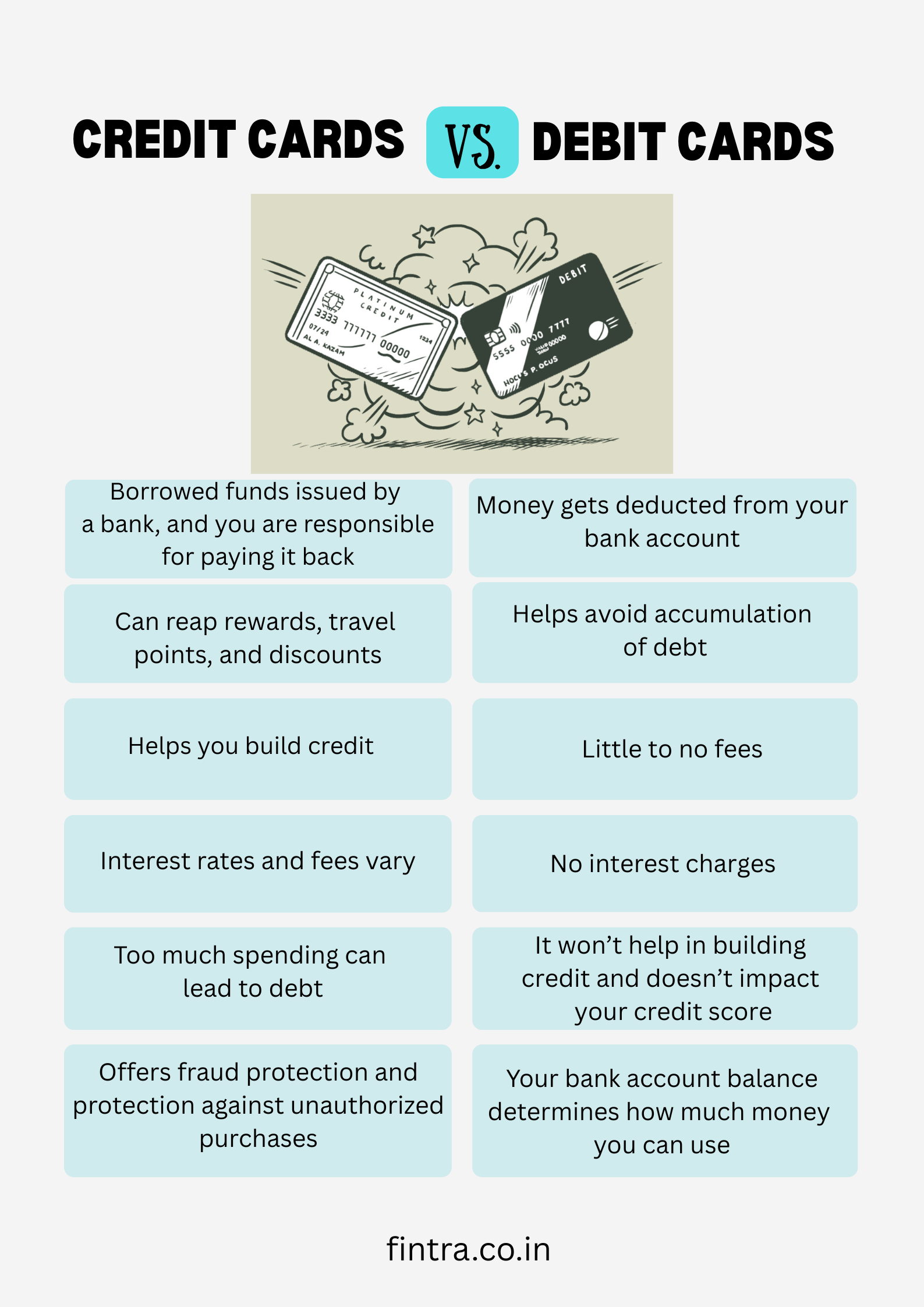

Key Differences Between Credit Cards and Debit Cards

The primary distinction between credit cards and debit cards lies in the source of the funds used for transactions. For example, credit cards allow you to borrow money from a financial institution up to a predetermined limit, and debit cards enable you to spend money directly from your bank account. Ask yourself: Am I borrowing or spending? This fundamental difference has a significant impact on how each card type influences your spending habits and overall financial health. Understanding these key differences is crucial for making informed decisions about which card to use in various situations.

Another critical difference is the effect on your credit score. Credit cards play a vital role in building and maintaining your credit history, as timely payments and responsible use can positively impact your credit score. In contrast, debit card usage does not directly affect your credit score, as these transactions are not reported to credit bureaus. This makes credit cards a valuable tool for individuals looking to establish or improve their creditworthiness. Debit cards are more suitable for those who prefer to avoid the complexities of credit management.

Additionally, the fees and rewards associated with each card type vary significantly. Credit cards often come with annual fees, interest charges, and potential penalties for late payments or exceeding your credit limit. However, they also offer various rewards programs, such as cash-back, travel points, and other perks, which can be highly beneficial for frequent users. Debit cards, on the other hand, generally have lower fees and fewer rewards, but they provide a more straightforward and disciplined approach to spending. By understanding these key differences, you can better evaluate which card type aligns with your financial goals and spending habits.

Pros of Using Credit Cards

One of the most significant advantages of using credit cards is the ability to build and improve your credit score. Responsible use of credit cards, such as making timely payments and keeping your balance low relative to your credit limit, can positively impact your credit history. A strong credit score is essential for obtaining loans, mortgages, and other financial products at favorable interest rates. Additionally, many landlords and employers consider credit scores when evaluating rental applications or job candidates, making it crucial to maintain a good credit standing.

Credit cards also offer a wide range of rewards and perks that can enhance your spending experience. Many credit cards provide cash-back rewards, travel points, and discounts on various products and services. These benefits can add up over time, providing significant value to frequent users. Some credit cards also offer additional protections, such as extended warranties, purchase protection, and travel insurance, which can provide peace of mind and added security when making large purchases or traveling.

Another advantage of credit cards is the ability to manage cash flow more effectively. By using a credit card, you can make purchases and pay for them later, allowing you to manage your finances more flexibly. This can be particularly useful in emergencies or when you need to make a large purchase but do not have the funds immediately available. Credit cards also provide detailed statements and transaction histories, making it easier to track your spending and budget effectively. Overall, the benefits of using credit cards can be substantial, particularly for those who use them responsibly and take advantage of the rewards and protections they offer.

Cons of Using Credit Cards

Despite the many advantages, credit cards also come with several potential drawbacks that can negatively impact your financial health if not managed properly. One of the most significant disadvantages is the risk of accumulating debt. Because credit cards allow you to borrow money up to a certain limit, it can be easy to overspend and carry a balance from month to month. This balance accrues interest, often at high rates, which can quickly add up and lead to substantial debt if not paid off on time.

Credit cards also come with various charges that can erode the benefits they offer. Annual fees, late payment fees, over-limit fees, and balance transfer fees are just a few examples of the costs associated with credit card use. These fees can add up over time, reducing the overall value of any rewards or perks you may receive. Additionally, missing payments or carrying high balances can result in penalties and a negative impact on your credit score, making it more difficult to obtain favorable terms on loans and other financial products in the future.

Another potential downside of credit cards is the temptation to overspend. The convenience and ease of use of credit cards can make it tempting to make purchases that you may not be able to afford. This can lead to a cycle of debt and financial stress if not managed carefully. Additionally, the availability of credit can create a false sense of financial security, leading to poor spending habits and a lack of discipline. By being aware of these potential pitfalls, you can better manage your credit card use and avoid the negative consequences associated with irresponsible spending.

Pros of Using Debit Cards

Debit cards offer several advantages that make them a more appealing option for various consumers. One of the most significant benefits is the ability to maintain control over your spending. Because debit cards are directly linked to your bank account, you can only spend the money you have available. This can help prevent overspending and reduce the risk of accumulating debt, making it easier to manage your finances and stick to a budget. For individuals preferring a more disciplined approach to money management, debit cards provide a straightforward and effective solution.

Compared to credit cards, another advantage of debit cards is the lower fees. Most debit cards don’t have annual fees, and transaction fees are usually minimal or non-existent, depending on your bank's policies. This can make debit cards a more cost-effective option for everyday purchases. Additionally, many banks offer overdraft protection, which allows you to cover transactions even if your account balance is insufficient. While this service often comes with fees, it can provide a safety net in emergencies, ensuring that your transactions are not declined.

Debit cards also offer the convenience and security of electronic payments without the complexities associated with credit cards. They are widely accepted for both in-person and online transactions, making them a versatile option for everyday use. Many debit cards also come with additional security features, such as fraud protection and the ability to set spending limits or receive transaction alerts. These features can provide peace of mind and added security when managing your finances. Overall, the simplicity and direct nature of debit cards make them an attractive option for those who prioritize financial discipline and straightforward money management.

Cons of Using Debit Cards

While debit cards offer several advantages, they also come with some potential drawbacks that consumers should be aware of. One of the main disadvantages is the lack of rewards and perks compared to credit cards. Debit cards typically do not offer cash-back rewards, travel points, or other incentives that can enhance your spending experience. For individuals who frequently use their cards for purchases, this can be a significant drawback, as they may miss out on valuable benefits that credit cards provide.

Another potential downside of debit cards is the limited impact on your credit score. Because debit card transactions are not reported to credit bureaus, they do not contribute to building or improving your credit history. This can be a disadvantage for those seeking to establish or enhance their creditworthiness, as responsible debit card use does not positively impact their credit score. For these reasons, individuals who desire to build or maintain a strong credit profile find credit cards to be a more suitable option.

Additionally, debit cards can pose a higher risk in cases of fraud or unauthorized transactions. While most banks offer fraud protection and the ability to dispute unauthorized charges, the process can be more cumbersome and time-consuming compared to credit cards. In some cases, funds may be temporarily unavailable while the bank investigates the issue, which can cause inconvenience and financial stress. Furthermore, debit cards do not offer the same level of purchase protection and extended warranties that many credit cards provide, making them less suitable for large or high-value purchases. By understanding these potential drawbacks, consumers can make more informed decisions about when and how to use their debit cards.

Choosing the Right Card for Your Spending Habits

Selecting the right card requires careful consideration of your financial goals, lifestyle, and preferences. For example, for those who prioritize building and maintaining a strong credit score, credit cards are an essential tool. Responsible use of credit cards, such as making timely payments and keeping balances low, can positively impact credit history and improve creditworthiness. Additionally, credit cards offer various rewards and perks that can provide significant value to frequent users. If you are confident in your ability to manage credit responsibly and take advantage of the benefits, a credit card may be the right choice for you.

On the other hand, if you prefer a more straightforward and disciplined approach to spending, a debit card may be a better fit. Debit cards allow you to spend only the money available in your bank account, helping to prevent overspending and reduce the risk of accumulating debt. They also come with lower fees and fewer complexities compared to credit cards, making them a cost-effective and convenient option for everyday purchases. For individuals who value simplicity and financial discipline, debit cards provide a practical solution.

Ultimately, the decision between credit cards and debit cards depends on each person’s needs and financial habits. Some may find that a combination of both card types offers the best of both worlds, allowing them to enjoy the benefits of credit while maintaining control over their spending. By carefully evaluating the pros and cons of each card type and considering your financial goals, you can make an informed decision that aligns with your unique needs and preferences.

Conclusion

In conclusion, knowing the differences between credit cards and debit cards is vital for making informed financial decisions and managing money effectively. Both card types offer unique advantages and drawbacks, which can significantly impact your overall financial health. Credit cards provide the opportunity to build and improve credit scores, enjoy various rewards and perks, and manage cash flow more flexibly. However, they also come with the risk of accumulating debt, various fees, and the temptation to overspend. Debit cards, on the other hand, offer a more disciplined approach to spending, with lower fees and immediate access to funds, but they lack the rewards and credit-building benefits of credit cards.

Carefully consider your financial goals, lifestyle, and spending habits before determining which card type best suits your requirements. Whether you choose to use credit cards, debit cards, or a combination of both, responsible management and a clear understanding of the potential benefits and pitfalls are crucial for maintaining financial health and achieving your long-term goals. Armed with the knowledge from this ultimate guide, you can navigate your financial journey with confidence and clarity, making smart spending decisions that support your overall well-being and financial success.